Losses deductions for computers software etc. On the whole youll be met with the same forex and cfd trading tax implications in australia as you would if you were share trading.

8 Expert Tips In Starting A Forex Trading Business My Business

8 Expert Tips In Starting A Forex Trading Business My Business

Ask questions share your knowledge and discuss your experiences with us and our community.

Forex trading ato tax. 1 is tax payable when i withdraw money from the trading account or when the trades close at profitlo! ss in the trading account. The ato is mainly concerned with your profits losses and expenses. Who knows one day you might like the look of the bundbobl and schatz markets.

When it comes to forex trading youll be met with the same forex and cfd trading tax implications in australia as you would if you were share trading. Im an australian resident for tax purposes i also have a full time job out on the mines in the nt. Wider spreads can have the effect of higher trading costs.

The ato is mainly concerned with your profits losses and expenses. Hi ato im a forex trader that has just gotten into a live trading account. Forex options and futures are grouped in what is known as irc section 1256 contracts.

Unfortunately that means there is no tax free forex trading in australia nor in any other asset. Who knows one day you might like the look of the bundbobl and schatz markets. These provisions were inserted into the! itaa 1997 by the new business tax system taxation of financia! l arrangements act no.

The vehicle you used to generate your income is secondary. Unfortunately that means there is no tax free forex trading in australia nor in any other asset. All foreign income deductions and foreign tax paid must be translated converted to australian dollars before including it in your return.

2 i keep seeing references to a 20k turnover rule for when you can claim tax deductions against forex trading income eg. The foreign exchange forex measures are contained in division 775 and subdivisions 960 c and 960 d of the income tax assessment act 1997 itaa 1997. These irs sanctioned contracts give traders a lower 6040 tax consideration meaning that 60 of gains or.

Our ato community is here to help make tax and super easier. From 1 july 2003 there are specific rules that tell you which exchange rate to use to convert these amounts. Generally these require amounts to be converted at the exchang! e rate prevailing at the time of a transaction or at an average rate.

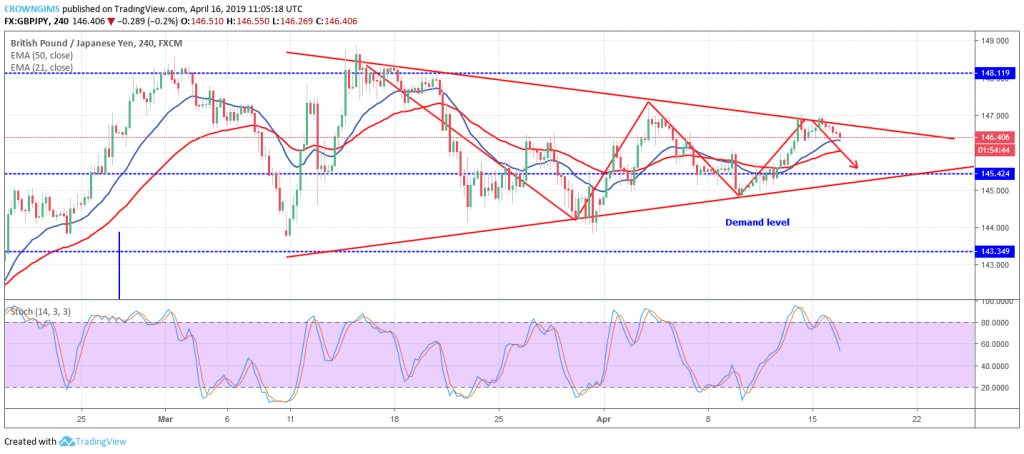

Forex Trading Gbpjpy May Break Out From Symmetrical Triangle At

Forex Trading Gbpjpy May Break Out From Symmetrical Triangle At

Equifax Work At Home

Five Questions Yo! u Ll Need To Answer Yes To If The Ato Calls

Five Questions Yo! u Ll Need To Answer Yes To If The Ato Calls

Coriel Electronics What Is Trading Stock Ato Top 10 Binary Options

Coriel Electronics What Is Trading Stock Ato Top 10 Binary Options

Do I Have To Pay Taxes For My Profits From Forex Trading In

Australian Tax Office Ato Issues Further Clarity On Bitcoin Taxation

Review Into! The Ato S Use Of Benchmarking To Target The Cash Economy

Forex Trading Signal Best Fx Binary Options Scalper 81

Ato Forex

Top 10 Forex Trading Rules You Should Know Atoz Markets

Crypto Trading Gets The Attention Of Australia S Tax Office

Crypto Trading Gets The Attention Of Australia S Tax Office

Australian Taxation Office Australian Times

Tax Portfolio Repo! rting Stockbroking Platform Cmc Markets

Tax Portfolio Repo! rting Stockbroking Platform Cmc Markets